The Philippines is a well-known agricultural country— blessed with fertile 30 million hectares of land for farming and surrounding fresh sea waters that encourage healthy and sustainable fishing.

President Duterte even declared it himself that “Philippine Agriculture is the backbone of the Economy. It forms the basis for food and nutrition security and provides raw materials for industrialization.“

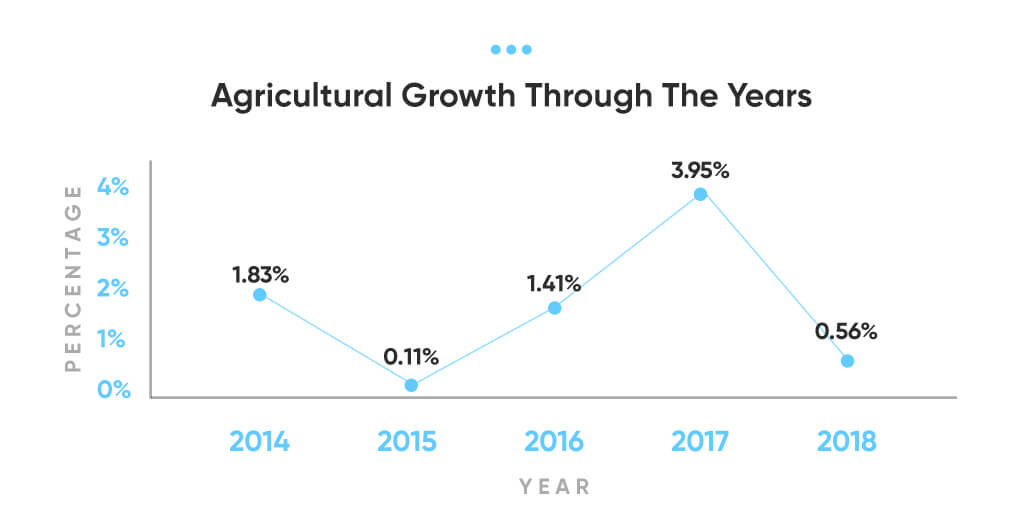

But in recent years, the Philippine agricultural growth has been erratic and has been in steady decline for a decade. The growth of the sector in 2014 was 1.83 percent, slid to 0.11 percent in 2015, and inched up by 1.41 percent in 2016. In 2017, it grew by 3.95 percent but posted a dismal 0.56 percent growth in 2018.

The reasons for the decline are all too familiar Philippine agriculture issues: low productivity, limited product diversification, high production costs, and low government support relative to other sectors of the economy. Then comes the entrance of cheaper food imports and climate change that has brought periodic droughts and floods that devastated crops and livelihoods.

“But why is the country’s lifeblood, the poorest and the most underserved industry the whole economy?”

Let’s dig deep into one of the primary hurdles of farmers in the Philippines: financial support.

Filipino Farmers Underserved and Under Siege

Photo courtesy of Tuan Anh Tran via Unsplash

On February 14, 2019, President Rodrigo Duterte signed Republic Act 11203 or the Rice Liberalization Law to minimize inflation rates after he imposed the Tax Reform Acceleration and Inclusion (TRAIN) Law back in 2018. The Rice Liberalization law claimed to be beneficial to Filipino farmers. Data from Philippine Rice Research Institute (PhilRice) says otherwise, showing a P61.77 billion loss to Filipino farmers due to the rice import liberalization law.

In another study by the Bantay Bigas watch group, Filipino rice farmers lost at least P74.8 billion in 2019 due to low farmgate prices of palay, citing the Rice Liberalization Law as the primary culprit to blame.

Other than the financial difficulty that Filipino farmers face, they are also under siege with the administration.

In a study by international advocacy group Pesticide Action Network-Asia Pacific (PAN-AP), the Philippines ranked as the top country dangerous to land rights advocates, especially Filipino farmers, with the death of 76 farmers out of 98 political killings in Southern Mindanao.

Dawn af a New Agricultural Decade

Photo courtesy of Rexy Quieta via Unsplash

The government may have succeeded in distributing lands to farmers through Agrarian Reform, but it failed to help farmers sustain the area they were given.

Enter Quirino Representative Junie Cua with House Bill No. 5681 (HB 5861) or the “Rural Agricultural and Fisheries Financing Enhancement System Act.” The bill underscores the need to organize and train Filipino farmers in cooperatives with professional managers who can access credit financing from banks.

According to Cua, “One of the serious problems besetting our farmers and our fisherfolk is the lack of financing, lack of credit. Why? Because it is costly to lend to small farmers. The cost of lending is very high.”

That is why HB 5861 seeks to promote rural development by enhancing access to rural communities, agricultural, and fisheries households to financial services and programs.

The bill also seeks to set up an agricultural, fisheries, and rural financing system to improve the welfare, competitiveness, income, and productivity of rural community beneficiaries, particularly farmers, fisherfolk, and agrarian reform beneficiaries.

What HB 5681 means to Farmers in the Philippines?

Photo courtesy of MENAFN Website

With HB 5681 coming into the place, the bill mandates all banking institutions, whether government or private, to set aside a credit quota or a minimum mandatory agricultural and fisheries financing requirement of at least 25 percent of their loanable funds.

Under the bill, agricultural, fisheries, and rural financing shall consist of loans, investments, and grants to finance activities that shall enhance productivity and competitiveness, as well as sustainable development of rural communities.

Initial contributions include penalties due from banks on their compliance or under-compliance with the mandatory Agri-Agra credit requirements under Republic Act No. 10000, collected after the effectivity of the proposed Act, the net of the ten percent amount to be retained by the Bangko Sentral ng Pilipinas (BSP). It is expected the amount shall not be less than P10 billion; any shortfall will be filled in and contributed by the banks themselves.

Any violators of the Act will result in penalties on non-compliance or under-compliance and shall be computed at one-half of one percent (0.50 percent), or any rates prescribed by the BSP Monetary Bard.

The HB 183 also mandated the Land Bank of the Philippines (LANDBANK) to “focus on its Charter to allocate sixty percent (60%) of its total loan portfolio in solely providing support and financing services for farmers and fisherfolk.”

“The bill seeks to promote inclusive growth and improve the quality of life in the countryside. It will foster continuity and expansion of responsive financial and support services to all farmers and fisherfolk,” Deputy Speaker Michael L. Romero said in a press release.

An Additional Aide for Filipino Farmers

Photo courtesy of Mau Victa via Rappler

To further aid farmers in the Philippines, the Social Security System (SSS) and Philippine Crop Insurance Corp. (PCIC) is set to bring social security coverage to one of the most vulnerable sectors of society, our farmers and fisherfolk in the provinces.

With the help of PCIC’s regional network, SSS can now over more potential members, a pension fund that provides social security protection in times of sickness, maternity, disability, unemployment, retirement, funeral, and death.

The collaboration between SSS and PCIC brings immense security to farmers in the Philippines since PCIC can provide insurance protection to farmers and fisherfolk in times of calamities, plant diseases, and pest infestation. While SSS can help and encourage agriculture workers to develop financial independence.

With a partnership like this, Filipino farmers will no longer cling to informal lenders, and loan sharks with rates go as high as 20 percent a month. They can rely on their own, with the help of these organizations, to help cultivate their land and build their future.

The Future of Farmers in the Philippines

Photo courtesy of MENAFN Website

As the Filipino adage goes, “magtanim ay ‘di biro” (farming is not a joke). It’s not only physically difficult but nowadays financially as well. That is why we need to support Filipino farmworkers in any way we can.

With all the partnerships and bills set in place for Philippine agriculture,there is a hopeful spirit in the air that the future could look bright for our Filipino farmers in the coming decade.

Digital Banking as the Solution

Photo courtesy of WorldBank Website

With loopholes in the providing finances to the agriculture sector, public and even private companies and institutions are chipping in to help support and save the country’s lifeblood.

Other than the government aid provided, digital banking is paving the way for people in rural areas, especially our agriculture workers, for better financial support.

By digitizing rural banks—that have an expansive reach to the rural and agriculture community— we can bring more Filipinos into the formal financial system. This will enable us to deliver a whole range of financial services catering to the unique needs of farmers and their communities.